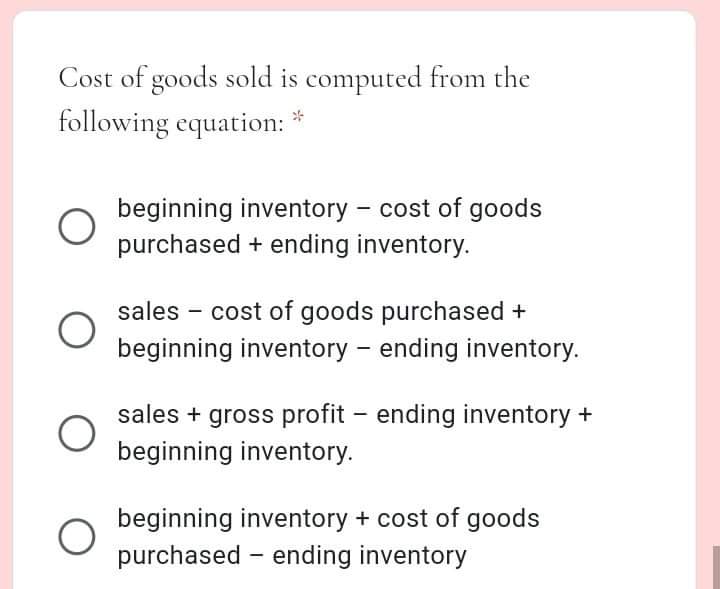

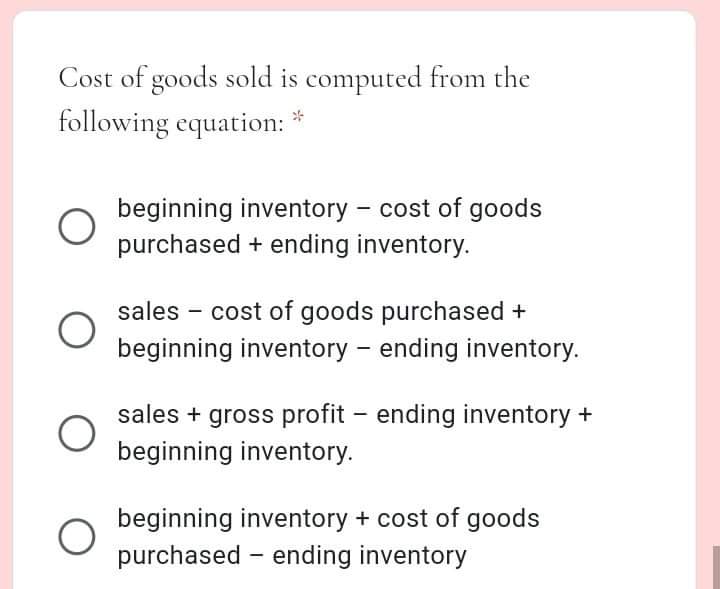

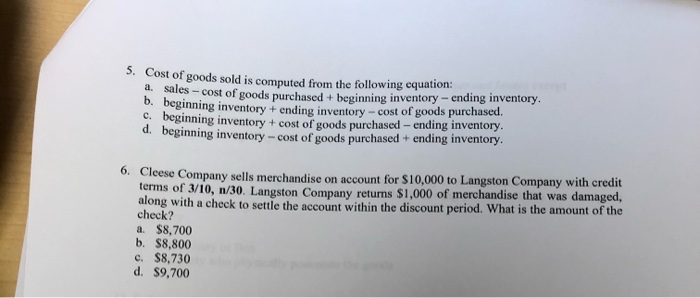

Cost of Goods Sold Is Computed From the Following Equation:

Sales gross profit ending inventory beginning inventory. A beginning inventory - cost of goods purchased ending inventory.

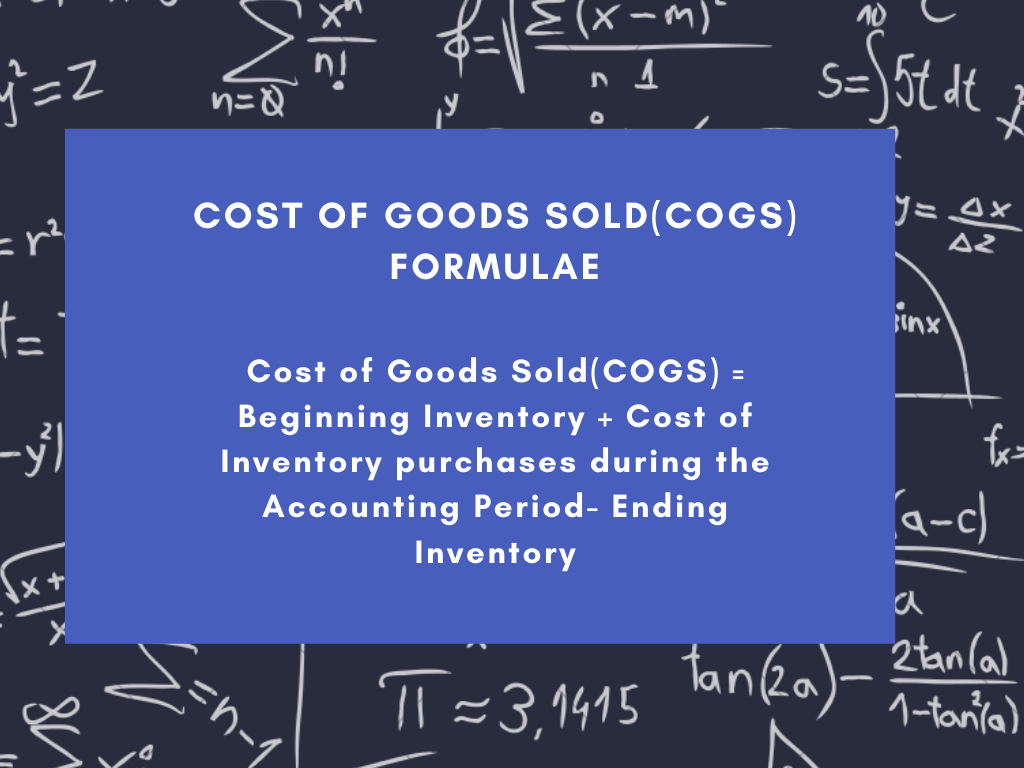

What Is Cost Of Goods Sold Cogs Definition Calculation Examples

Beginning inventory cost of goods purchased ending inventory.

. Plus Other Costs 1100 Sub-total 45531. D sales gross profit - ending inventory beginning inventory. Cost of goods sold is computed from the following equation.

Plus Cost of Labor 12350. Beginning inventory cost of goods purchased ending inventory. Beginning inventory Purchases - Ending inventory Cost of goods sold.

Question 27 3333 out of 3333 points Cost of goods sold is computed from the following equation. Removing 1820 leaves an inventory balance of 260 780 1300 1820 representing the cost of the one remaining unit. Select from the followingthe incorrect statement regardingcontribution margin.

Beginning inventory - cost of goods purchased ending inventory. Sales gross profit ending inventory beginning inventory. Sales - cost of goods purchased beginning inventory - ending inventory.

ASales Gross Profit - Ending Inventory Beginning Inventory BBeginning Inventory - Cost of Goods Purchased Ending Inventory CSales - Cost of Goods Purchased Beginning Inventory - Ending Inventory DBeginning Inventory Cost of Goods Purchased - Ending Inventory. The cost of goods sold is the cost of the merchandise that a retailer distributor or manufacturer has sold. Cost of Goods Sold on Schedule C.

Cost of goods sold Opening Inventory Cost of goods purchased - Closing inventory. Beginning inventory cost of goods purchased ending inventory. Importantly COGS is based only on the costs that are directly utilized.

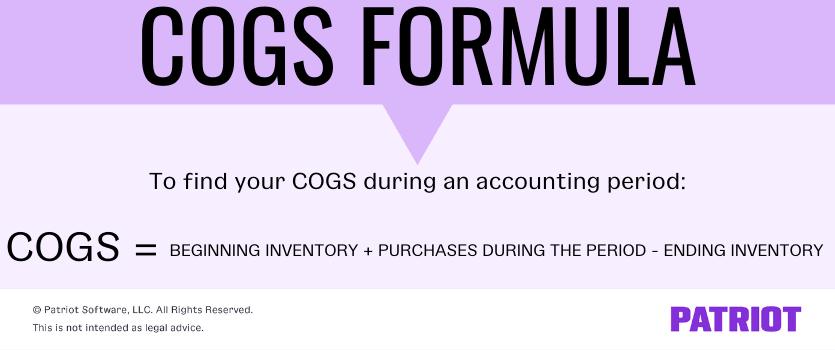

COGS Beginning Inventory Purchases Closing Inventory. Inventory at Beginning of Year 15500. Cost of goods sold is computed from the following equation.

An alternative way to calculate the cost of goods sold is to use the periodic inventory system which uses the following formula. A cost that contains both fixed and variableelements is referred to as a. This is because Opening Purchases Total maximum level of inventory held during the year out of which some will be sold and some will be kept as part of closing inventory.

Beginning inventory cost of goods purchased - ending inventory. Formula To Calculate Cost of Goods Sold COGS The formula to calculate the Cost of Goods Sold is. Sales gross profit ending inventory beginning inventory.

Below are the accounting equationsGross Profit Sales - Cost of goods soldCost of Goods Sold Opening Stock Purchases - Closing Stock. C beginning inventory cost of goods purchased - ending inventory. Equals Cost of Goods 27201.

The 1260 difference between revenue and cost of goods sold for this sale 3080 minus 1820 is the markup also known as gross profit or gross margin. Beginning inventory - cost of goods purchased ending inventory. Beginning inventory cost of goods purchased ending inventory.

Cost of goods sold COGS is calculated by adding up the various direct costs required to generate a companys revenues. Remember we want to calculate the cost of the merchandise that was sold during the year so we. Beginning inventory cost of goods purchased - ending inventory.

Cost of goods sold is computed from the following equation. Beginning inventory cost of goods purchased ending inventory. Cost of goods sold is calculated using the following formula.

The cost of goods sold formula is calculated by adding purchases for the period to the beginning inventory and subtracting the ending inventory for the period. Beginning inventory cost of goods purchased - ending inventory. Sales gross profit - ending inventory beginning inventory.

B sales - cost of goods purchased beginning inventory - ending inventory. Cost of Goods Sold Calculation with the Periodic Inventory System. It is reported on a companys income statement and when subtracted from revenue shows.

Sales cost of goods purchased beginning inventory ending inventory. Cost of goods sold is computed from the following equation. Cost of Goods Sold is computed from the following equation.

Sales gross profit ending inventory beginning inventory. Sales cost of goods purchased beginning inventory ending inventory. Sales variablemanufacturing costs contribution margin b.

Cost of goods sold is computed from the following equation. Beginning inventory ending inventory cost of goods purchased. The LIFO inventory method assumes that the cost of the latest units purchased are.

Sales - cost of goods purchased beginning inventory - ending inventory. Beginning inventory cost of goods purchased ending inventory. Minus Inventory at End of Year 18330.

Thus Total Opening Purchases - Closing Inventory Cost of goods sold. Cost of goods sold is computed from the following equation. Beginning inventory cost of goods purchased ending inventory.

Net income total fixed costs contribution margin c. Where Beginning Inventory is the inventory of goods that were not sold and were leftover in. The cost of goods sold equation might seem a little strange at first but it makes sense.

Cost of goods sold is computed from the following equation. Beginning Inventory Cost of Goods - Ending Inventory Cost of Goods Sold At the beginning of the year the beginning inventory is the value of inventory which is actually the end of the previous year. Plus Materials and Supplies 8200.

Sales cost of goods purchased beginning inventory ending inventory.

Cost Of Goods Sold Definition Cogs Formula More Patriot Software

Answered Cost Of Goods Sold Is Computed From The Bartleby

Solved 3 Cost Of Goods Sold Is Computed From The Following Chegg Com

No comments for "Cost of Goods Sold Is Computed From the Following Equation:"

Post a Comment